Producer Price Index PPI Forecast

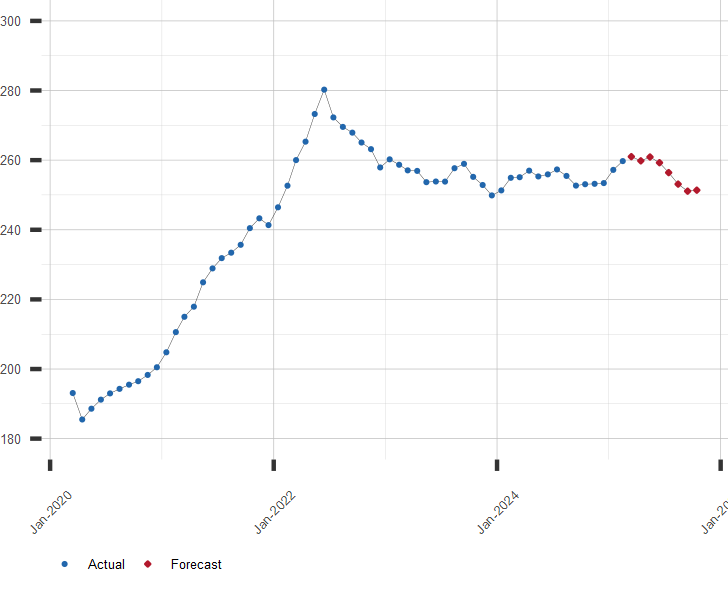

Below is a forecast of the U.S. producer price index, or PPI, broken down by month. This forecast is produced based on prior values of the PPI along with other factors such as commodity prices, currency exchange rates and economic indicators. To learn more about how this forecast is produced, please see our methodology page.

U.S. Producer Price Index, PPI, Predicted Values

Price Index All Commodities. 1982=100. Not Seasonally Adjusted

| Month | Date | Forecast Value | Avg Error |

|---|---|---|---|

| 0 | Jan 2026 | 261.5 | ±0.0 |

| 1 | Feb 2026 | 263.7 | ±0.5 |

| 2 | Mar 2026 | 264.1 | ±0.7 |

| 3 | Apr 2026 | 263.9 | ±0.8 |

| 4 | May 2026 | 262.3 | ±0.8 |

| 5 | Jun 2026 | 263.7 | ±0.9 |

| 6 | Jul 2026 | 265.7 | ±0.9 |

| 7 | Aug 2026 | 267.3 | ±0.9 |

| 8 | Sep 2026 | 267.7 | ±1.0 |

Get the Rest of the Story with the 5 Year Forecast!

Chart of U.S. PPI with Forecast.

All Commodities Price Index. 1982=100. Not Seasonally Adjusted.

What Causes the Producer Price Index?

The primary cause of the PPI is crude oil prices, both WTI and Brent. As the price of crude oil goes up, the PPI will go up.

Another cause is the price of natural gas (Henry Hub). As the price of natural gas goes up, the PPI will go up.

The Canadian Dollar, Australian Dollar and Singapore Dollar also figure heavily in the causation of the PPI. As the AUD, CAD and SGD strengthen versus the U.S. dollar, the PPI will go up. One of the reasons these currencies are causes of the PPI is because they also figure heavily in the causation of crude oil prices.

Other Price Index and Industry Resources:

A long range forecast for the U.S. PPI and other similar economic series is available by subscription. Click here for more information or to subscribe.

| March 03, 2026 | |

| Indicator | Value |

|---|---|

| S&P 500 | 6816.63 |

| U.S. GDP Growth, YoY % | 2.23 |

| U.S. Inflation Rate, % | 2.39 |

| Gold Price, $/oz-t | 8055.84 |

| Crude Oil Futures, $/bbl | 74.56 |

| U.S. 10 Year Treasury, % | 4.06 |