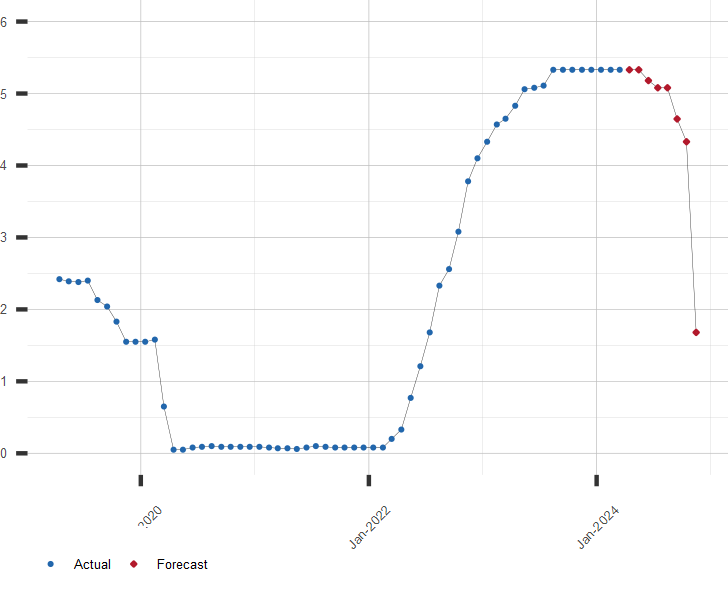

Fed Funds Rate Forecast

Below is a detailed forecast of the Fund Funds interest rate by month.

This forecast is produced based on prior values of the fed funds rate along with other factors such as inflation, U.S. employment, and the U.S. housing market.

Fed Funds Rate Forecast Values

Interest Rate. Percent, Average of Month.

| Month | Date | Forecast Value | Avg Error |

|---|---|---|---|

| 0 | Nov 2025 | 3.88 | ±0.00 |

| 1 | Dec 2025 | 3.70 | ±0.08 |

| 2 | Jan 2026 | 3.60 | ±0.095 |

| 3 | Feb 2026 | 3.13 | ±0.10 |

| 4 | Mar 2026 | 2.96 | ±0.11 |

| 5 | Apr 2026 | 2.63 | ±0.11 |

| 6 | May 2026 | 2.26 | ±0.12 |

| 7 | Jun 2026 | 2.03 | ±0.12 |

| 8 | Jul 2026 | 1.88 | ±0.12 |

Get the Rest of the Story with the 5 Year Forecast!

Chart of Fed Funds Rate

U.S. FRB Fed Funds Rate, Percent Per Year. Includes Current Prediction.

The U.S. Fed Funds Rate

The U. S. Federal Funds Rate is the interest rate a U.S. Federal Reserve depository institution (bank, S&L or Credit Union) will charge another bank to borrow their excess reserves held at the Federal Reserve. These reserves, or Federal Funds, are traded by banks (usually overnight) to meet their reserve requirements or enable the clearing of financial transactions.

Other Interest Rate Resources of Interest:

A long range forecast for the Fed Funds Rate, Prime Rate, and similar economic series is available by subscription. Click here for more information or to subscribe now!

| December 22, 2025 | |

| Indicator | Rate, % |

|---|---|

| Prime Rate | 7.00 |

| 30 Year Treasury Bond | 4.84 |

| 10 Year Treasury Note | 4.17 |

| 91 Day Treasury Bill | 3.64 |

| Fed Funds | 3.64 |

| SOFR | 3.66 |

| 30 Year Mortgage Rate | 6.21 |